Nerding out on Nerdwallet

A deep-dive into the financials and corporate strategy of an SEO success story

Phew. Last week I opened up enrollment for the SEO MBA course on executive presence. Thank you to everyone who supported this launch and helped spread the word. Truly, thank you.

Now, on to the regularly scheduled programming.

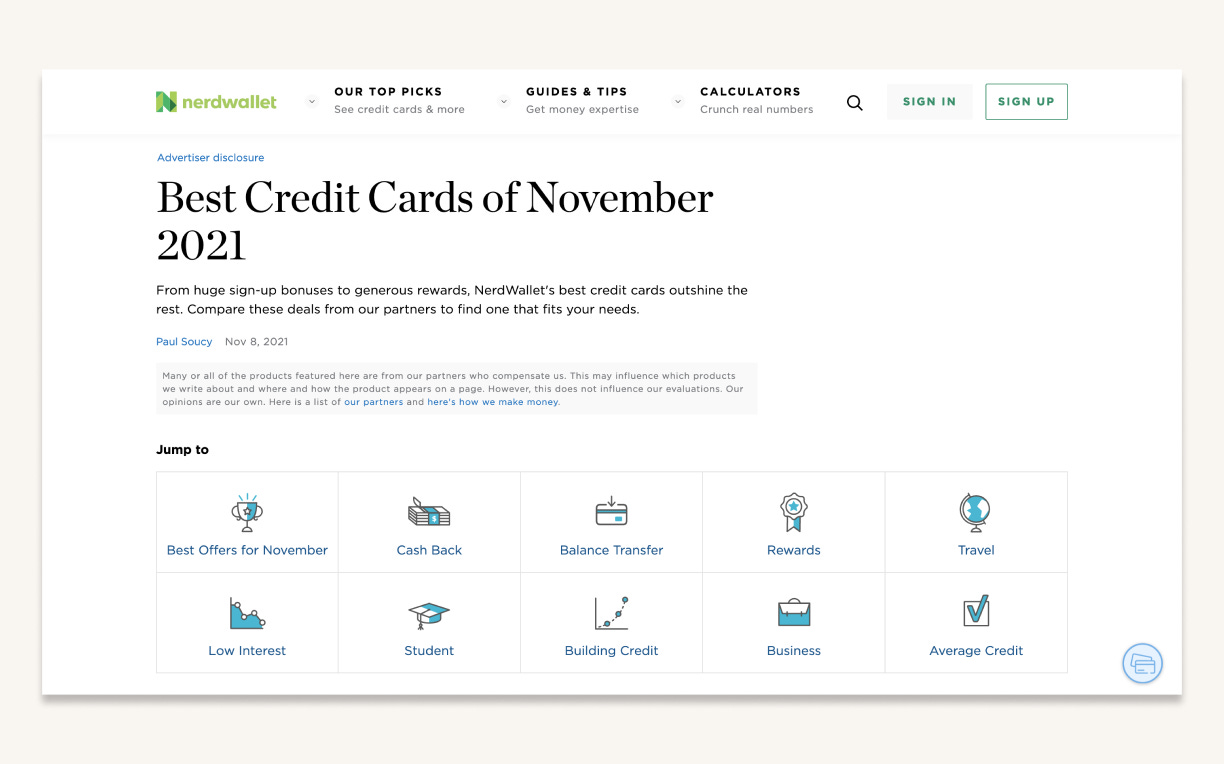

Nerdwallet is an SEO behemoth. Whether or not you work in the finance space you’ve likely paid attention to their SEO performance - they’ve dominated hyper competitive terms like “best credit cards” for… well a long time.

Last week, Nerdwallet IPO’d (NASDAQ: NRDS) and as part of that process they filed an S-1 document which is an overview of their business. I’m not a financial analyst and reviewing these documents can be a slog, BUT I think it’s good practice for training your mind to think about business and finance in the way the C-suite does.

So let’s dive in and see what we can learn!

Disclosure: I’ve never worked with Nerdwallet as a client, though I did consult with Fundera for a period in 2015 which was acquired by Nerdwallet in 2020. And I've had many clients over the years that have competed with Nerdwallet. This email is most definitely not financial advice.

This one’s a longer email - mostly because I quote directly from their S-1. So I’ve broken it up into sections:

Summary & overview

Growth levers

Revenue Mechanics

Content accounting

Brand marketing

Missed opportunities

1. Summary & Overview

Nerdwallet has dominated the highly competitive personal finance space for a long time. They don’t depend ONLY on organic traffic, but it’s a huge part of their business:

In the trailing twelve months as of June 30, 2021, approximately 73% of our traffic on NerdWallet came from direct or unpaid traffic sources, further demonstrating the value of our brand, organic marketing efforts and strategy.

They generated $245m revenue in 2020 and they’re still growing aggressively:

They continue to invest heavily in growth and I don’t see them slowing down:

Some key inflection points for the business mentioned in the S-1:

In Q3 2020 they expanded their operations into Canada

In Q3 2020 they acquired Know Your Money for ~$13.7m, a UK financial comparison site focused on consumer and SMB products and meaningfully expanded into the UK market

In Q4 2020 they acquired Fundera for ~$65.1m, a US based SMB financial platform

2. Growth Levers

Nerdwallet talks about a lot of growth levers in the S-1 but outside of continued operations I see two key areas for growth:

2.1 International Expansion

From the S-1, bolding mine:

Historically, all of our business has been generated in the United States and we have little experience operating internationally. In 2020, we entered the United Kingdom (UK) market with our acquisition of Notice Media Ltd. (doing business as Know Your Money), an online provider of financial guidance and tools based in the UK. We entered the Canadian market organically in the third quarter of 2021. We believe our growth strategy depends, in part, on our continued international expansion.

International expansion was mentioned again and again in the S-1, likely to prepare investors for continued investment and expansion.

In particular, they acquired Know Your Money in Q3 2020 and immediately folded the domain into nerdwallet.com/uk. Seems to have worked pretty well for them:

Following our 2020 acquisition of Know Your Money (KYM), an online provider of financial guidance and tools in the United Kingdom, KYM was rebranded as NerdWallet UK. By deploying our playbook, organic traffic to the NerdWallet UK site has increased from approximately 10,000 monthly sessions pre-acquisition to approximately 90,000 monthly sessions in the second quarter of 2021. This early proof point has encouraged us to invest in further global expansion.

This certainly seems like a way to accelerate growth. Compare their UK expansion (via acquisition) with their organic self-directed Canada expansion:

I wouldn’t be surprised if Nerdwallet makes more announcements here soon and follows the same strategy - acquiring an international player with existing partnerships, reasonable content and limited revenue and simply folds it into the Nerdwallet domain, CMS and platform - instantly driving growth.

2.2 Acquisitions

Acquisitions aren’t just about international growth however, the Fundera acquisition seems to have been very successful for them. From the S-1 (bolding mine):

For example, in the fourth quarter of 2020, we acquired Fundera, which allows us to both improve our offering for SMBs by providing a human touch during one of their biggest financial decisions and build a deeper relationship to anticipate future needs. Upon integration, we combined NerdWallet's top-of-funnel strength to increase organic SMB traffic by over 30% with Fundera’s monetization strategy, which almost doubled up-front revenue per NerdWallet SMB visit and adds a recurring revenue tail, as 50% of Fundera’s loan revenue in the year prior to acquisition came from existing customers. We can apply this playbook to other existing verticals that have relationship-driven or renewal revenue models.

In particular Fundera has a deeper revenue integration than Nerdwallet - i.e. they have a sales team and deeper partnerships in the SMB space. This essentially allows Nerdwallet to monetize their traffic more effectively.

I wouldn’t be surprised if we see more acquisitions like this - where Nerdwallet acquires a niche player with a more integrated revenue model and suddenly increases revenue from existing traffic.

In fact, it might be pure speculation but I was surprised how Nerdwallet listed Zillow as one of their key competitors in the S-1. Might Nerdwallet be investing behind home loans in the future? Are they monetizing this traffic correctly today?

3. Revenue Mechanics

The core business model for Nerdwallet is fairly straightforward; when a user clicks on a financial product they leave the site and get taken to a financial provider. If they complete the signup Nerdwallet gets paid a kickback.

(Yes, sometimes it gets a bit more complex, their revenue can come from “revenue per action, revenue per click, revenue per lead, and revenue per funded loan arrangements” but the core mechanic is basically the same)

They have clearly created some fairly sophisticated revenue modeling internally, including the ability to connect traffic to revenue:

Transaction price is considered variable and an estimate of the constrained transaction price is recorded as revenue when the match occurs, subject to a constraint. Constrained revenue is recognized to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur. After our initial estimate and constraints are made, we reassess our estimates and constraints at the end of each reporting period. Various factors are analyzed to estimate the constrained revenue, including historical approval rates and historical time between when a consumer request for a financial product is delivered to a financial services partner and when the financial product is approved by such financial services partner.

I talk about this in the SEO MBA course, that in order to operate at the senior levels of business you need to be able to connect SEO traffic to revenue. Here, Nerdwallet is essentially estimating the future revenue for each outbound click and measuring that as revenue. This enables them to operate with the same kind of financial awareness an e-commerce site might; directly monitoring per page revenue, measuring revenue by source etc.

However, it’s not always quite so straightforward. I found it interesting to read how their revenue was impacted by Covid:

While consumer demand for many financial services products was high in 2020, for portions of the year some of our financial services partners tightened underwriting criteria or were slower to approve applications for certain products and some reduced advertising budgets given the inherent economic uncertainty.

So, Nerdwallet needs consumer demand. But too much demand can harm their revenue (bolding mine):

Decreased consumer demand for mortgage refinancing typically leads to decreased traffic to our platform and results in higher associated marketing costs with generating traffic. Conversely, during periods with decreased interest rates, mortgage partners have less incentive to use our platform due to high consumer demand or in the case of sudden increases in consumer demand, our financial services providers may lack the ability to support such increases in volume.

For example, in the Spring and Summer of 2020 the rapid surge in demand for mortgage refinancing due to low interest rates reached such levels that our mortgage partners did not have the capacity to process all of the demand, thus reducing the need to pay to acquire consumers, which in turn constrained our mortgage business. Situations like this could harm our business, financial condition and results of operations.

This means that Nerdwallet does best when it operates in this “goldilocks zone” of just the right amount of demand. Too little, and they don’t make money, too much and partners feel that they don’t need Nerdwallet.

And because of this, while overall Nerdwallet did pretty well in 2020, the makeup of their business changed quite dramatically. From credit cards being 53% of revenue pre-pandemic to 32% today:

4. Content Accounting

I don’t have much to say here except that I was hoping for some insights and the S-1 did not deliver. For a business like Nerdwallet that invests so heavily in content they have few details about how their editorial operation works, how they account for content over time, how often they update it etc. Editorial investment is simply lumped in with “sales & marketing”

This is all we get unfortunately:

In the trailing twelve months as of June 30, 2021, approximately 73% of all traffic to NerdWallet came organically through direct or unpaid channels, reflecting the strength of our brand and organic marketing efforts. Our in-house, award-winning and experienced editorial team leverages search-engine optimization best practices and technology, and designs interfaces to help consumers easily find the information they are seeking.

Our editorial team also optimizes page structure to increase visibility, not only for organic search results, but also for Google’s premium features such as FAQs, featured snippets, and video results.

Personnel-related expenses within organic marketing were up 9% in 2020 compared with the same period in 2019, which is a reflection of our continued investment in building a comprehensive set of skills and expertise across our editorial team. We will continue to invest heavily in our marketing channels going forward, and believe that our marketing strategy will continue to position NerdWallet as the trusted brand of choice in personal finance, improve traffic acquisition at all levels of the funnel, drive engagement and enable us to scale quickly across new consumer finance verticals and geographies.

And there’s 100+ people working on content:

The cornerstone of our platform is consumer trust in the independent, objective, and relevant guidance we provide, free of charge. Given it is incredibly difficult for any one person to be deeply knowledgeable across all areas of personal finance, we have a 100+ person editorial team that functions as the “brains” behind our guidance

Humph. I bet they have a sophisticated accounting model for content investment, content refreshes and so on but they’re not giving anything away in the S-1.

5. Brand Marketing

Talking of sales and marketing, it’s clear from reading the S-1 that brand marketing is a central part of their business:

Brand recognition is a key differentiating factor between us and our competitors. We believe that continuing to build and maintain the recognition of our brand is important to achieving increased demand for the products we provide.

They invest heavily in brand marketing - it’s 30-40% of their overall sales and marketing spend (which was $144m in 2020):

In 2020, approximately 39% of our total marketing expense was attributable to brand marketing, 34% to performance marketing, and the remainder to organic marketing and other marketing expenses. During the first half of 2021, approximately 43% of our total marketing expense was attributable to brand marketing, 33% to performance marketing, and the remainder to organic marketing and other marketing expenses.

Their S-1 says they measure brand marketing through aided awareness. This interview with their CMO says the same thing and gives a bit more color:

CM: What’s your measurement approach to brand marketing?

KG: Before you launch a campaign, it’s important to level set on your key KPIs. [Determine] the fitness function, and then think about the right benchmarks for the project. When we launched our first national campaign in late 2019, we did a series of tests leading up to that to see what campaign concepts did well. How did this move our business? What metrics should be expected to move and where do we think this is most impactful for us? Our key fitness function is aided awareness, so we’re gunning for a certain number of points of aided awareness we’ll get with each campaign as the outcome. Then we look at things, like traffic to our website and our monthly active users in our mobile app. Are we driving more traffic of quality level we’re happy with? Are people very interested and engaged? Are we driving registration?

We’ve seen a lot of down-funnel impact to the business that we also measure. It’s not the primary fitness function of what we’re looking for our brand marketing to do. I have a background as an economist, so I’m always building models and looking at how we can understand complex systems, all these different points of marketing. We lean on our models and our MMX model to assess if this is incremental growth, is this cannibalistic growth, is our marketing building and complimenting what we have today.

I’d love to see that link between brand marketing and organic performance in more detail and understand how they are measuring performance here (their CMO is a former economist) - but again, unfortunately no such nuggets made it into the S-1. All we get is this hint:

Brand marketing campaigns, such as “Turn to the Nerds,” which encourage consumers to turn to NerdWallet with all of their money questions, increase awareness and drive top-of-funnel interest, while amplifying the effectiveness of our organic and performance marketing channels.

All of our marketing programs and channels are measured by a data-driven media mix model to determine results and effectively allocate marketing investments to drive maximum business impact.

As we emerge (hopefully) on the other side of the pandemic I think we’ll see even more aggressive brand marketing. This interview with their CMO in May 2020 suggests they were poised to expand their brand marketing just before Covid hit:

At the beginning of [2020], NerdWallet had embarked on its first national branding campaign. The consumer finance site bought prime-time TV ads to turn the decade-old company into a household name for money advice.

The campaign’s Q1 exceeded performance benchmarks, so CEO Tim Chen recommended extending the campaign into Q2 with a bigger budget.

Then the coronavirus pandemic happened.

6. Missed Opportunities

Here’s a few things I thought could have been stronger:

6.1 Registered Users

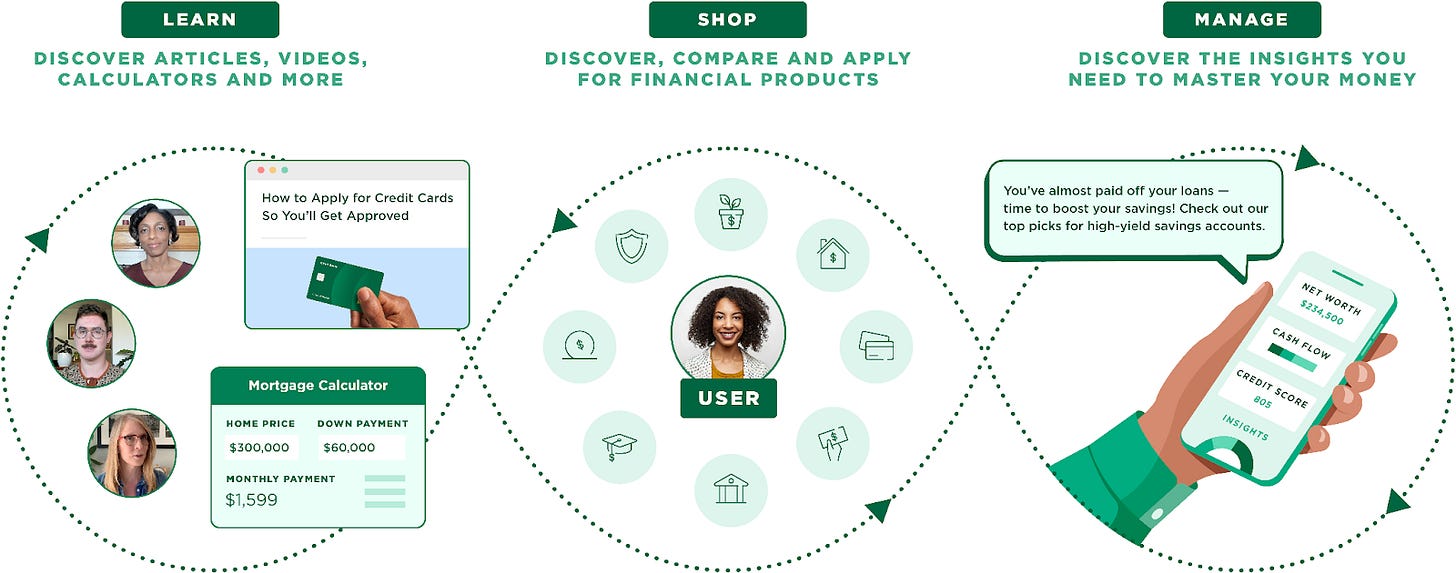

Nerdwallet’s business relies on this cycle between top of funnel awareness and traffic (via brand marketing and SEO) and loyal users and registered users:

Since 2016, we have started converting unique users into Registered Users that utilize our consumer decisioning tools and increased machine learning functionality. We had over 5.5 million Registered Users as of December 31, 2019, 8 million Registered Users as of December 31, 2020 and over 9 million Registered Users as of June 30, 2021.

Honestly this number is quite low and suggests that they don’t yet have a great way of converting top of funnel traffic into loyal repeat users. Compare it to My LendingTree, a similar registered user platform. From LendingTree’s latest quarterly earnings report:

My LendingTree performed well in Q3 as personal loans gained strength on the platform, growing 25% quarter-over-quarter, resulting in revenue contribution of $16.6 million. We continued to grow our user Q3.2021 6 base, adding 1.1 million new users in the quarter and bringing cumulative signups to 20.0 million

So, not only is My LendingTree larger (20m vs 9m) but it’s growing faster (1.1m / qrtr vs 0.5m / qrtr). In addition - for all Nerdwallet talks a good game about their registered users, there’s no mention of revenue generated by these registered users. Compare that to LendingTree who are quantifying and measuring registered user revenue ($16.6m / quarter).

You can explain this for Nerdwallet one of a few ways, either:

They have deliberately decided to focus on their bread and butter of organic search and content and don’t plan to make this a big strategic bet (despite the talk of “machine learning algorithms” in the S-1).

They have tried to invest and grow their registered user base and app installs but they’re just not that good at it compared to their competitors. After all, this kind of user acquisition isn’t in their DNA.

They have invested here but plan to significantly ramp up their operations and invest more heavily in the future behind a big growth opportunity.

I’m not gonna speculate but… I have my opinions here.

6.2 Cryptocurrency

The Nerdwallet S-1 doesn’t mention crypto once. This feels a bit odd to me when you consider the scale at which crypto is impacting other financial players. For example Robinhood:

Robinhood's [Q3 2021] transaction-based revenue from cryptocurrency trading rose 860% YOY to $51 million.

It feels like a potential missed opportunity for Nerdwallet not to take this space seriously.

Now, Nerdwallet IS investing in crypto content - they rank number one for “how to buy cryptocurrency” for example. But they are behind some of the more focused competitors and I was surprised to see no mention in the S-1. Are they taking this new growth area seriously enough? Or are they playing a more cautious game to see how the current market evolves?

Again, two ways to read this:

They’re doing just fine - they have crypto content and it’s performing well. This will be a steady growth area.

They are investing but not taking it seriously enough and risk ceding this industry and content to more focused and dedicated players.

It might be too soon to say which of these is true but I’d be keen to see them break out crypto revenue as a distinct business unit in future earnings reports.

Wrapup

I’m not a big finance nerd (no pun intended) but if you want to operate at the executive layer of business then you should make yourself comfortable reading things like S-1 documents and quarterly earnings reports.

Especially for a business like Nerdwallet that is so dependent on organic traffic this will help sharpen your business thinking and help you put yourselves in the shoes of the C-suite.

Absolutely stunning display of the power of domain authority: KYM folds into a new /uk/ folder of NerdWallet's domain, with no existing traffic, and overnight the same content grows its SEO traffic by 10x. Really demonstrates the problem Google has created for itself now we know more about Navboost and similar algorithms which continually reinforce bigger brands/domains by rewarding them with better positions to earn more traffic, brand awareness and links, which reinforces their rankings, CTR and authority, which reinforces their traffic, brand awareness and links etc. etc.

These domains can just dominate SEO regardless of content quality, because the algorithm is increasingly set-up to just continually reinforce their domains, suppressing content from smaller domains. KYM content on NW's domain (and probably some hreflang help) is now worth 10x more.